News Bulletin

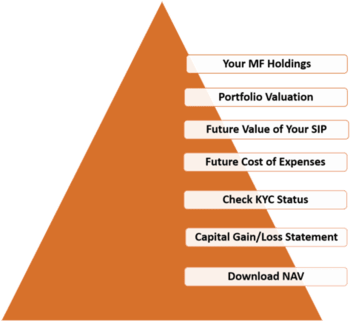

Vital links

Parivartan is a unique investment solution offered by Simply Invest that helps investors convert their stock

market losses into assured profits. By selling underperforming shares and constructing a new portfolio

(Parivartan Portfolio), investors can protect their capital with a 3% annual fee.

After one year, if the

new

portfolio incurs losses, Simply Invest will fully reimburse the difference. Additionally, if the portfolio

doesn’t generate at least 3% extra profit compared to the old one, the initial fee is refunded. Profits remain

entirely with the investor, and the protection can be renewed annually.

A Systematic Investment Plan (SIP) is a method of investing in mutual funds where an investor invests a fixed amount of money at regular intervals (usually monthly) over a specified period. This approach is designed to help investors build wealth gradually while mitigating risks associated with market volatility.

Key Features of SIP in Mutual Funds:

• Fixed Investment Amount: Investors decide on a specific sum to invest

regularly, making it easier to plan finances.

• Regular Contributions: SIPs allow for automatic deductions from the

investor's bank account, ensuring discipline in saving and investing.

• Long-Term Focus: SIPs are typically recommended for long-term financial goals,

helping investors to accumulate wealth over time.

Merits of SIP in Mutual Funds:

1. Rupee Cost Averaging:

SIPs enable investors to average out the cost of their investments over time.

When market prices are low, more units are purchased, and when prices are high, fewer units are bought.

This helps in reducing the overall cost of investment.

2. Disciplined Saving:

SIPs encourage a disciplined approach to saving and investing.

By committing to regular investments, investors develop a habit of saving consistently,

which can lead to significant wealth accumulation over time.

3. Affordability:

SIPs allow investors to start with small amounts, making mutual funds accessible to

a broader range of individuals. This is particularly beneficial for new investors

or those with limited disposable income.

4. Mitigating Market Timing Risk:

With SIPs, there is no need to time the market.

Investors can participate in the market regardless of current conditions,

reducing the pressure to make investment decisions based on market fluctuations.

5. Convenience:

SIPs are convenient to set up and manage.

Investors can automate their investments, making it hassle-free

to grow their wealth without constant monitoring.

6. Flexibility:

SIPs offer flexibility in terms of investment amounts and frequency.

Investors can choose to increase or decrease their SIP amounts or even pause their

investments based on their financial situation.

7. Compounding Benefits:

Regular investments through SIPs allow investors to take advantage of the power of compounding.

The returns generated on investments can be reinvested to earn additional returns over time,

significantly boosting overall wealth.

8. Goal-Based Investing:

SIPs can be aligned with specific financial goals, such as funding education,

marriage, or retirement, allowing investors to plan effectively for their future.

Conclusion

SIPs in mutual funds provide a structured and disciplined approach to investing, making it easier for

individuals to build wealth over time. The combination of rupee cost averaging, convenience, and the potential

for compounding returns makes SIPs an attractive option for both novice and experienced investors.

Click here to see a vivid

image of realizing

your Life's dreams

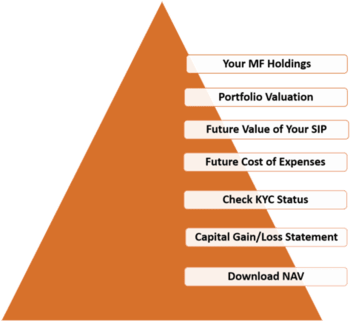

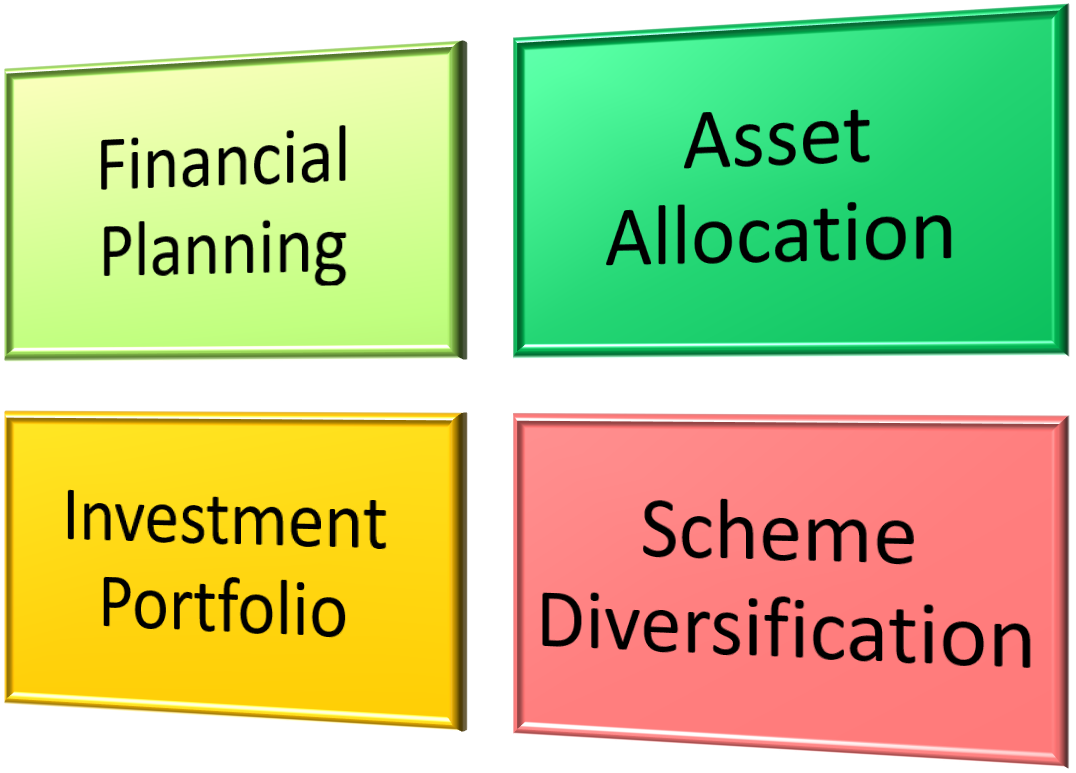

Financial Planning:Simply Invest offers tailored financial planning services, specializing in asset allocation and portfolio diversification.

Asset Allocation: Simply Invest's asset allocation strategy is powered by expert research and seamless integration of online services, ensuring success for clients.

Investment Portfolio:Simply Invest offers a single point of contact with a trusted advisor, supported by a team of experts.

Scheme Diversification:Simply Invest emphasizes scheme diversification to help clients spread their investments across various asset classes, reducing risk while maximizing potential returns.

Investor Mentoring:Simply Invest assists clients in achieving their local and global financial goals through personalized expert guidance and support.

P – 329, C.I.T.Road, 1st Floor, Kankurgachi,

Behind Ram Krishna Samadhi Road P.O,

Kolkata

– 700

054,

WB, India

Call: (+91) 9831051920

Email: simplyinvest@yahoo.in